The term “policyholder behavior” refers to the decisions that policyholders (individuals, groups or organizations) make in selecting and using the benefits and guarantees implicit in life insurance products.

It is clear that the future behavior of policyholders affects the price and risk management for most life insurance products: interrupting the payment of premiums and terminating all or part of the insurance contract causes undoubted impacts.

It is therefore essential that the actuarial models accurately describe the future actions of the policyholders and are able to measure the risk factors associated with the degrees of freedom granted to them by the contractual conditions.

The regulatory evolution of recent years has made a decisive contribution to bringing the analysis of policyholders’ behavior to the attention of operators more and more, imposing more advanced reporting and increasingly sophisticated regulatory solvency standards.

Just think of the introduction of fair value accounting, or the provision for Solvency II (BEL) purposes based on expected cash flows.

The requirements required by the introduction of Solvency II and ORSA first and then of IFRS17 have increased the need to regularly monitor and update the assumptions of insurance behavior to define and quantify the risk factors (both market and product) around the products insurance.

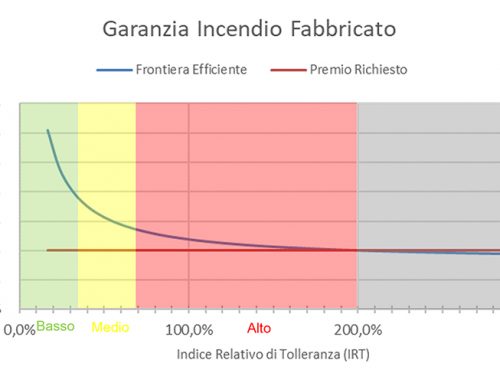

Algoritmic, has prepared a research and some analysis of market experiences and scientific contributions on both static and dynamic redemption models. From this analysis it emerged that:

- There are discrete-time and continuous-time models with approaches that describe the behavior of the policyholder in the literature, with respect to surrender, as “rational” (both in a neutral risk environment and in an adverse risk environment) or “irrational”.

- The market generally applies an irrational model for the “static” part of redemptions (hereinafter PHB) and a rational or partially rational model for the “dynamic” part (hereinafter DPHB).

- For the “static” component in literature most of the irrational models are based on generalized linear models such as Logit, Probit or Tobit. The market uses simple regression models or generalized linear Logit-type models.

Our scientific but also operational vocation on the subject has allowed us to deepen these topics by helping some large Italian life insurance companies to tackle this topic, proposing an original approach for the calibration of a double sigmoid function.

By clicking HERE you can find the abstract of the article published by Springer entitled “An application of Sigmoid and Double-Sigmoid functions dynamic policy holder behavior”.

Sign up to our NEWSLETTER on the blog page and you will receive the entire article.

Enjoy the reading.

Stay In Touch