On February 23rd, 2023, the European Insurance and Occupational Pensions Authority (EIOPA) issued a Supervisory Statement with which EIOPA aims to clarify supervisory expectations with regards to the existing requirements in the IDD legislative framework and promote a convergent approach amongst competent authorities in the supervision of POG, fair treatment of customers and disclosure requirements, with a view to preventing unfair differential pricing practices that lead to customer detriment, whilst not interfering directly with business decisions and/or pricing.

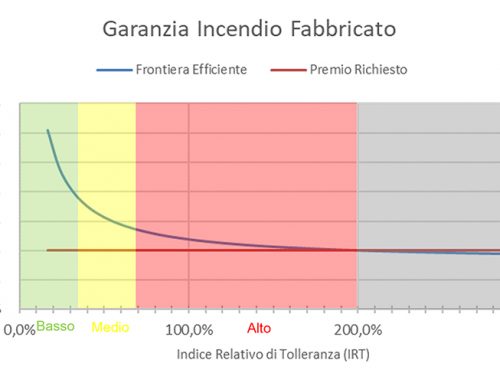

Particular emphasis is placed on the so-called “price walking practices”, i.e. when the premium paid by the customer is repeatedly increased during the renewal phase based on non-risk-related factors.

According to EIOPA, new technologies such as Artificial Intelligence (AI) and the greater availability of new data sets (Big Data), allow companies to increasingly adapt the pricing of premiums to customer behavior decorrelating il from the actual risk. Particularly in non-life insurance, where there is high competitive pressure, EIOPA notes the risk that less price-sensitive customers, who have limited access to digital tools that could allow them to compare insurance products and who are more inclined to renew their insurance contracts without looking for an alternative, they could be penalized as identified as customers willing to pay an increasing premium.

SUPERVISORY EXPECTATIONS:

- Differential pricing practices must not result to unfair treatment.

- Product oversight and governance measures and procedures should ensure that differential pricing practices do not result in detriment.

Stay In Touch